Binomial tree option pricing excel

A binomial tree represents the different possible paths a stock price can follow over time. If the price of a stock is known at the beginning of a period, the price at the beginning of the next period is one of two possible values. Hence, if the price at the beginning of the period is C , it will be either Cu or Cd at the next period.

If the stock is assumed to behave the same way, then at the end of step 2, the stock can take on 3 possible values and can take 4 possible paths to get to them.

A two-period option value is found by working backward a step at a time. We will use a 9-step Cox, Ross, and Rubinstein CRR binomial tree. An American option offers the possibility of early exercise before the expiration date of the option.

For call options on a stock that pays no dividends prior to expiration, early exercise is never optimal, given that prices are such that no arbitrage is possible.

Option Pricing Models (Black-Scholes & Binomial) | Hoadley

The Black-Scholes equations can be used to calculate European options on stocks with known dividend yields. If we know that a stock will pay only one dividend within the period for which we are building a binomial tree, we can compute the Present Value of the dividend, subtract it from the initial price of the stock, and treat the remainder as its uncertain component.

We thus build the tree by using the uncertain component of the stock price. The present value will get larger as we traverse closer to the time of the dividend payment. The same methodology can be used if there are multiple dividend payments during the time covered by the tree.

Cox, Ross, and Rubinstein CRR have shown that if we chose the parameter for a binomial tree and probability of up movement as follows, then the tree closely follows the mean and variance of the stock price over short intervals and we can use risk-neutral evaluation. For stocks that do not pay dividends, q will simply be 0.

The parameters are then found for 9 steps as:. Let us dive into the implementation part of Binomial Option Pricing Excel example. Simply enter the parameters;.

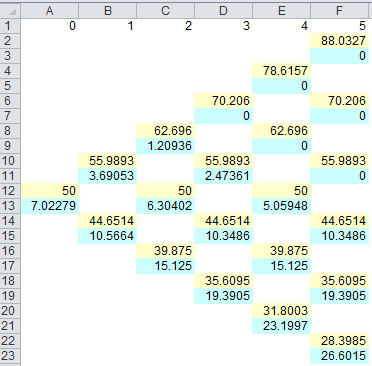

41 Excel Binomial Tree with European OptionsThe accompanied VBA inside the spreadsheet conveniently builds a binomial tree in the shape of a triangle. The upward movement values take the upper triangle. The downward movement values take the lower triangle.

Binomial Option Pricing Model

The columns represent the the successive steps and are numbered starting from 0. The difference in calculating the price of a call and a put option occurs at the nodes at expiration.

Options pricing with Binomial trees in Excel spreadsheets

There is no need to build separate models or Puts and Calls. The tree has been constructed for illustrating the stock and option price upward and downward movements.

Download Binomial Option Pricing Excel Spreadsheet. About Jish FAQs Invest Solver Engineering Methods for Business and Investing.

Share on Facebook Share. Share on Twitter Tweet. Share on Google Plus Share.

Share on Pinterest Share. Share on LinkedIn Share. Usagi Chee November 24, at 7: Jish Bhattacharya November 29, at Send me a note to my email address.

It is there on the spreadsheet. Usagi Chee December 3, at 1: Carlos March 25, at 3: Can I have the Password to the file? My name is Hung. Jish Bhattacharya May 12, at 9: Leave a Comment Cancel reply Social connect: Recent Posts Modified Sharpe Ratio Logistics Network Optimizing Warehouse Location Conditional Value At Risk Calculator Ulcer Index Indicator Garch Modeling in Excel and Matlab Commodities Trading Technical Indicators Relative Strength Index Plot Williams R Indicator Excel.

Categories Charts 6 Commodities 1 EMA 2 Logistics 1 MACD 2 Marketing Budget 1 Momentum Oscillator 1 Network Optimization 1 Options 4 Risk 5 Simulation 2 Supply Chain 1 Technical Analysis 4 Technical Indicators 7 Volatility 6.