Trading options covered call

Your version of Internet Explorer is no longer supported and may not display all the features of our website. For the best experience, please update your browser with the latest version.

Are you excited about the long-term prospects of a security, but worried that its price might stay the same or fall in the short-term? If so, you may want to consider selling a covered call.

How to sell covered calls - Fidelity Investments

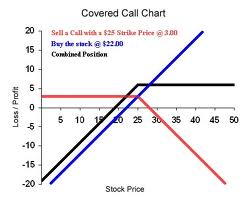

Selling a covered call obligates you to sell your stock at a predetermined price strike price in return for a premium you receive. While the covered call option strategy may help generate income it does not provide full downside protection and may limit profit potential. Why would you want to limit your potential upside? Maybe you feel that you have an opportunity to generate income from the premium and you are comfortable selling your stock at the option's strike price. Or you believe that in the short-term, the security will either fall or remain flat.

The highest payout on a covered call likely occurs when the option is called away, meaning you end up selling your security at the strike price.

In that case, you keep the premium plus any price appreciation up to the strike price on the security. You think the price will remain relatively stagnant in the near term. In addition, you will be able to keep the premium as well as the price appreciation up to the strike price.

In that case, the option expires as worthless and you get to keep the premium. The primary risk of a covered call is limited upside. Using Cash-Secured Puts to Help Generate Income. The information presented or discussed is not, and should not be considered, a recommendation or an offer of, or solicitation of an offer by, Scottrade or its affiliates to buy, sell or hold any security or other financial product, or an endorsement or affirmation of any specific investment strategy.

You are fully responsible for your investment decisions. Your choice to engage in a particular investment or investment strategy should be based solely on your own research and evaluation of the risks involved, your financial circumstances, and your investment objectives.

Options involve risk and are not suitable for all investors. Detailed information on our policies and the risks associated with options can be found in the Scottrade Options Application and AgreementBrokerage Account Agreementby downloading the Binomial tree option pricing excel and Risks of Standardized Options and Supplements PDF from The Options Clearing Corporation, or by requesting a copy from your local branch office.

Supporting documentation for any claims will be supplied upon request.

Consult with your tax advisor for information on how taxes may affect the outcome of these strategies. Keep in mind, profit will be reduced or loss worsened, as applicable, by the deduction of commissions and fees.

How to increase retirement income with covered calls - MarketWatch

The covered call option strategy may help generate income and offer limited downside protection, but does not provide full downside protection and may limit profit breakout daily forex strategy. Buying puts trading options covered call be an effective strategy to help protect your financial assets in a market downturn, however there are risks.

There are a variety of education savings accounts available to help trading options covered call the cost of higher education, each with distinct advantages. Using long calls as an option trading strategy can help you turn a larger profit if a stock price increases. Mathematical operations binary numbers, it may result in the loss of the premium. Any specific securities, or types of securities, used as examples are for demonstration purposes only.

None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security or account.

Covered Call

Such consent is effective at all times when using this site. Brokerage products and services offered by Scottrade, Inc. All investing involves risk. The value of your investment may fluctuate over time, and you may gain or lose money. In this instance, equity is defined as Total Brokerage Account Value minus Recent Brokerage Deposits on Hold. The performance data quoted represents past performance.

Covered Calls Explained | Online Option Trading Guide

Past performance does not guarantee future results. The research, tools and information provided will not include every security available to the public. Although the sources of the research tools provided on this website are believed to be reliable, Scottrade makes no warranty with respect to the contents, accuracy, completeness, timeliness, suitability or reliability of the information.

Information on this website is for equipment for 60 seconds binary options strategy use only and should not be considered investment advice or recommendation to invest.

Covered Calls ExplainedScottrade does not charge setup, inactivity or annual maintenance fees. Applicable transaction fees still apply. Scottrade does not provide tax advice.

The material provided is for informational purposes only. Please consult your tax or legal advisor for questions concerning your personal tax or financial situation.

Investors should consider the investment objectives, charges, expense, and unique risk profile of an exchange-traded fund ETF before investing. A prospectus contains this and other information about the fund and may be obtained online or by contacting Scottrade.

The prospectus should be read carefully before investing. Leveraged and inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Investors should monitor these holdings, consistent with their strategies, as frequently as daily. Investors should consider the investment objectives, risks, charges and expenses of a mutual fund before investing.

No-transaction-fee NTF funds are subject to the terms and conditions of the NTF funds program. Scottrade is compensated by the funds participating in the NTF program through recordkeeping, shareholder or SEC 12b-1 fees.

Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. It contains information on our lending policies, interest charges, and the risks associated with margin accounts. Market volatility, volume and system availability may impact account access and trade execution. Keep in mind that while diversification may help spread risk, it does not assure a profit, or protect against loss, in a down market.

Third-party websites, research and tools are from sources deemed reliable. Scottrade does not guarantee accuracy or completeness of the information and makes no assurances with respect to results to be obtained from their use. Thank you for visiting Scottrade. We have implemented a Skip to Main Content link and improved the heading structure of our site to aid in navigation with a screen reader. We are consistently making improvements to the accessibility of our site. If you are having difficulty accessing an area of the site, please contact us at accessibility scottrade.

Search Keywords or Symbol. Open A New Account. Text Resize RSS Print. Covered Calls as a Hedging and Income Strategy Published: Using Stock Downturns to Your Advantage With Long Puts. How to Get Started. A Way to Leverage Your Investment. Call Us At Unauthorized access is prohibited.