Single stock put call ratio

The ratio is based on put and call option volume, the former bets on a decline in stock or index prices, and the latter is used to bet on a rise in stock or index prices. Therefore, this ratio is typically used as a contrarian indicator.

Traders and hedge funds use options to make speculative bets, as well as hedge other positions. A call option is used if a trader expects an equity price to rise, or can be used to hedge a short stock position. A put option is used if a trader expects an equity price to rise, or can be used to hedge a long stock position. See also Options Individual traders usually are more active in the options of individual stocks, while hedge funds and the like are more inclined to trade index options.

If the ratio rises, there are an increasing number of puts relative to calls. If the ratio falls there are fewer puts relative to calls.

Put-Call Ratio for Individual Stocks

Be sure to also see Everything You Need to Know About Market Breadth Indicators. These levels will vary based on which ratio is used discussed above , as well as market conditions.

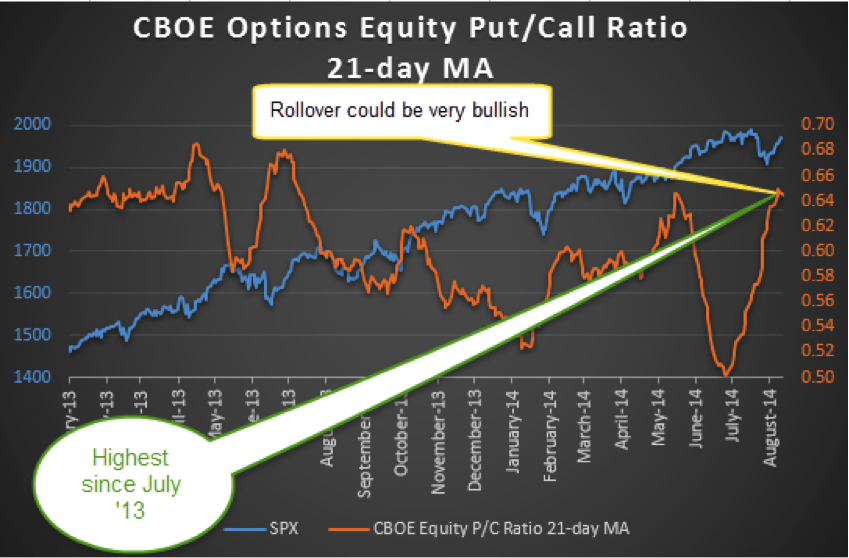

A long-term up or downtrend in the stock market may alter the exact levels used to indicate extreme bullishness or bearishness. This highlights how the levels the Ratio fluctuates between can change over time. This gives the indicator a smoother and easier to read appearance.

Figure 4 shows how this looks. The chart is much less choppy, although since an average is being used, the extreme levels need to be reduced. Extremes can last for some time; this is why traders typically wait for the average to drop back through the bearish extreme level green horizontal line before initiating a long, or waiting for the average to rally back above the bullish extreme level red horizontal line before initiating a short position.

In Figure 4 the buy signals occurred after the price had already begun to move higher, missing out on a large chunk of the move in some cases. The extreme levels are never fixed either.

Put/call ratio - Wikipedia

It may or it may not. The ratio can be choppy, but when it reaches a bullish or bearish extreme level, it can provide timely reversal signals. Are you looking for stocks that are showing signs of bottoming out? Are you looking for over-extended stocks to sell?

CBOE Daily Market Statistics

Active traders can use this list to find potential candidates and screen for the most attractive Enter your e-mail address to subscribe. Low Volatility ETFs invest in securities with low volatility characteristics. These funds tend to have relatively stable share prices, and higher than average yields. Investors who suspect that the stock market may be about to decline can take action to reduce the Thank you for selecting your broker.

Please help us personalize your experience. Your personalized experience is almost ready. Join other Individual Investors receiving FREE personalized market updates and research.

Join other Institutional Investors receiving FREE personalized market updates and research.

Join other Financial Advisors receiving FREE personalized market updates and research. Check your email and confirm your subscription to complete your personalized experience. Thank you for your submission, we hope you enjoy your experience.

Free Newsletter News Newsletter Articles Trader University Trading Securities Trading Platforms Trading Indicators Trading Strategies Lighter Side of TraderHQ Forex Trading TraderHQ.

Home News Newsletter Articles Trader University Trading Securities Trading Platforms Trading Indicators Trading Strategies Lighter Side of TraderHQ Forex Trading TraderHQ. Cory Mitchell Sep 25, Exotic Individual traders usually are more active in the options of individual stocks, while hedge funds and the like are more inclined to trade index options.

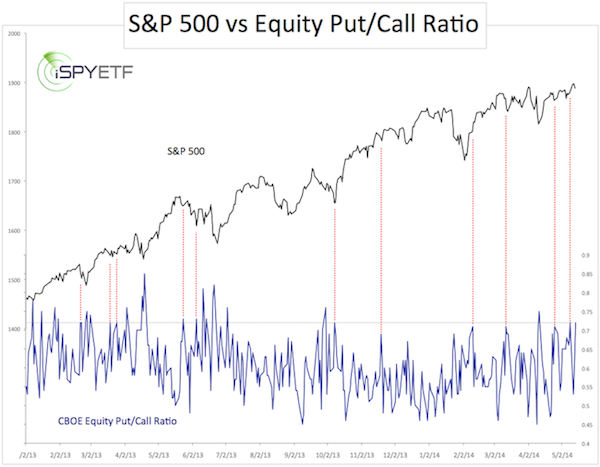

All charts courtesy of StockCharts. Since most individual traders are looking to profit from rising prices, this ratio tends to hover below 1; more calls than puts.

Major funds and even individual traders will often use index options to hedge other equity positions. Given the long-term upward bias in the stock market, and the tendency for uptrends to last longer than downtrends, this ratio tends to hover just above 1; slightly more puts than calls, because puts are used as a hedge against long equity positions.

Forecasting Market Direction With Put/Call Ratios

This helps eliminate the biases inherent in each ratio, and provides a broader picture of how all market participants feel about the stock market. Get Email Updates Subscribe to receive FREE updates, insights and more, straight to your inbox. News Most Oversold Stocks This Week: June 20 Sneha Shah Jun 20, News Most Overbought Stocks This Week: June 19 Sneha Shah Jun 19, News 25 Best and Worst Performing Stocks This Week: June 15 Sneha Shah Jun 15, Tools Periodic Table of Asset Bubbles. Education A Trader's Guide to Tops and Bottoms Beginner's Guide to Sector Rotation Top 21 Trading Rules for Beginners: A Visual Guide 50 Blogs Every Serious Trader Should Read What Is Day Trading?

Legal Privacy Policy Terms of Use Follow TraderHQ. Enter your e-mail address to subscribe Powerful trading insights sent every weekday morning Gain instant access to actionable trading tips Strategically improve your trading strategy. We Respect Your Privacy. Is your portfolio protected for what the markets will bring this fall?

Creating a properly diversified portfolio can be a difficult proposition, especially when ETF Investing Low Volatility ETF List Low Volatility ETFs invest in securities with low volatility characteristics. ETF Investing 10 ETFs for Risk Reduction in Your Portfolio Bob Ciura.