B-book forex

Forex trading is different from investing in shares or futures, because a broker can choose to trade against his clients.

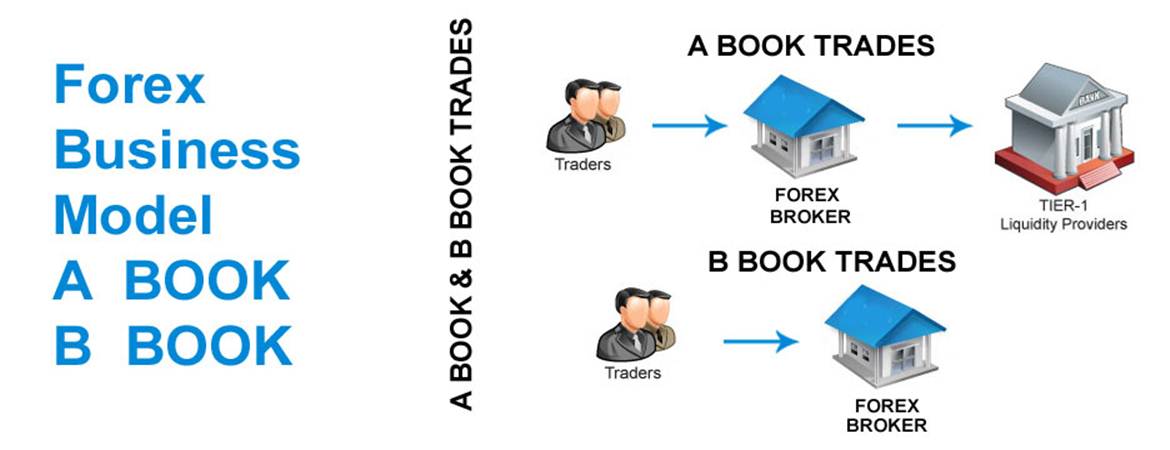

This system used by "Dealing Desk" Market Maker brokers is known as "B booking". They therefore use the "A booking" system.

However, many forex brokers use a hybrid model which uses a B Book for clients who lose money and an A Book for the profitable clients.

In the regulated futures contract and stock markets, all transactions are sent to an exchange that confronts buyers' and sellers' orders by sorting them according to price and time of arrival. These forex brokers make money by increasing the spread or by charging commissions on the volume of orders.

What is the A Book and B Book that forex brokers use?

Therefore, there are no conflicts of interest, these brokers earn the same amount of money with both winning and losing traders. This type of forex broker is becoming increasingly popular because forex traders are reassured by the absence of this conflict of interest, as well as the fact that these brokers have an incentive to have profitable traders since they will increase their trading volumes and therefore the brokers' profits.

Forex brokers that use a B Book keep their clients' orders internally.

They take the other side of their clients' trades, which means that the brokers' profits are often equal to their clients' losses. Brokerage firms are able to manage the risks associated with the holding of a B Book by using certain risk management strategies: As the majority of retail traders lose money, the use of a B Book is very profitable for brokers.

It is obvious that this model generates conflicts of interest between brokers and their clients. Profitable traders can cause these brokers to lose money. Traders are often worried about being subject to the underhanded tactics of some brokers who seek to always be profitable.

Book Transfer

That's why the larger market maker forex brokers use a hybrid model that involves placing trades in an A Book or in a B Book based on traders' profiles. The popularity of the hybrid model is understandable, as it allows forex brokers to increase their profitability as well as their credibility.

It also enables brokers to earn money off of profitable traders by dispatching their trading orders to liquidity providers. To efficiently identify profitable traders, as well as unprofitable ones, forex brokers have software that analyses their clients' orders.

The hybrid model is not necessarily a bad thing for traders because the profits made off of traders that are placed in the B Book enable hybrid brokers to provide all of their clients with very competitive spreads, whether they are profitable or not.

The main disadvantage of this system is that if a hybrid broker mismanages the risk of the B Book, he can lose money and therefore endanger the company.

Broker Comparison Bonuses Contests New at trading? Learn to Trade Forex Strategies Forecasts Tools Forum. Forex Trading Broker Comparison The Best Forex Broker? Bonuses and Rebates Trading Contests Trading Platforms Affiliate Programs Search this Site. Learn How to Trade How to Become a Trader Currency Trading Options Trading Forex Training Trader Psychology Forex Trading Videos Financial documentaries Are you LOST?!

Trading Strategies Trading Strategies Technical Analysis Fundamental Analysis Forex Trading Signals Automated Trading Social Trading Managed Accounts. What is the A Book and B Book that forex brokers use? How do I choose a broker: Forex and CFD broker comparison.