Risks selling covered call options

This week, we explore ten myths about covered call writing that you may have heard. This a good strategy if you know for certain that the stock is not going to move. But nothing in life is certain. Bristol Myers Squibb Co BMY , for instance pays a dividend yield of 4. But this might not be the best strategy.

The call offers only 1. Many investors assume that all options have their fastest rate of time decay just before expiration. That is not always the case with out-of-the-money calls. Often, one can narrow the spreads even further by entering a price limit on your rollover order. Often investors are reluctant to incur a cash loss closing out a short call that has moved in-the-money, and are therefore willing just to let their stock get called away.

You do not need to do this, however. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash.

Often, you can find the new positions that have attractive combinations of yield, protection and profit potential. However, there are plenty of instances where the shorter-term covered call will underperform the longer-term covered call on the same stock with the same strike. If the stock rises sharply, the longer-term covered call is less likely to give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection.

In fact, they rarely are.

How to sell covered calls - Fidelity Investments

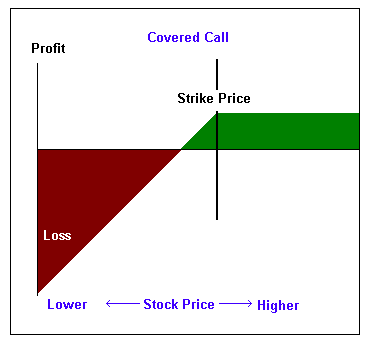

Most studies show that covered call writing is less risky on average than just owning stocks, with steadier cash flow and fewer losses.

However, covered calls have some risks of their own. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. However, you still will be able to keep the original premium at expiration. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts.

True, there may be some cases where it might be easier to exit a covered call than a put write, but in most instances, the risks are the same. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. Also, the strike price of the option and your expectations are important.

If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the call. Alternatively, if you expect the stock to end up above the strike, then the cash covered put may be preferable because the put expires worthless. In many cases, early exercise of your in-the-money short call can be a gift. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the call.

Writing Covered Calls: What Can go Wrong?

The only time you stand to lose is when there is a ex-dividend before expiration. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can do. First of all, there are times when put buying is just too expensive, and the only viable hedge is to a write a call on your stock. Our track record tends to show the best performance for covered calls following dips in the markets.

There is no reason why covered calls cannot be combined with other strategies.

For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. Other investors combine put and call purchases on other stocks along with their covered calls.

Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection.

Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts.

Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as well. Prepared by Lawrence D. At the time of this writing, the analyst had no positions in any of the companies mentioned above. Expand Dashboard Browse Research Markets Find Ideas Investment Education Subscribe Institutional.

How to Write Covered Calls: 4 Tips for Success | Ally

Cavanagh August 12, Related Links Defining Options Terms Adding Options to Your Portfolio Screening for Puts. Editor's Picks Dogs of the Dow Midyear Review The Coca-Cola Company: A Short SWOT Analysis Industrial Production Strengthens In July.

Most Viewed The Dogs of the Dow Regain, and Maintain Their Lead Volatile Alternative Energy Stocks Drug Roundup — May 15, Archived Commentaries An Option Strategy on Micron Technology An Option Strategy on Apple Inc. An Option Strategy on The Blackstone Group, LP Buying Naked Puts A Refresher Course on Our Old Screener.