Financial spread trading strategies

I am tired of self-proclaimed gurus charging hundreds of pounds to teach how to trade. Oh and if you what we're about, please spread the word.

Follow us on Twitter! Stock Market Workings Where Can I Spread Bet? Spread Trading Markets Compare Spreads Read and Write Reviews Learn Spread Betting Trading Course Day Trading Tutorials Ask LCG Financial Glossary Hedging with Spreads Fixed-Odds Financials Binary Betting Sports Spread Betting Trading or Gambling Gambling Entertainment Trading Plan 50 Golden Rules Directory Industry News.

Become a fan on Facebook Follow us on Twitter.

Reduce Taxes On Your UK Trading Profits! The late Benjamin Franklin is remembered for once famously saying, "There are two things you can be sure of in life - death and taxes! Financial Spread Betting falls nicely into this category. Subscribe Here is why: Trade against the market, not your broker. Please note spread betting can result in losses greater than your initial deposit.

Financial spread betting is leveraged trading. It provides traders and investors the opportunity to trade the financial markets without ever taking ownership of the underlying asset. Spread bets are geared trades which give you greater buying power and the potential for greater returns.

It leverages the value of your money regardless of the financial market that you are interested in, whether shares, commodities, indices, or even currencies, and its flexibility allows you access to all these markets from just one account.

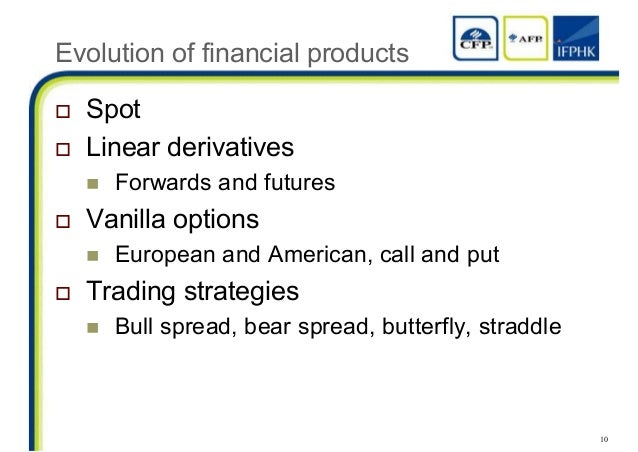

Spread trading is a form of derivative trading which means you don't actually own any of the shares that you are trading but are simply trading on the direction of the share price i. What is Spread Trading? So what is a Spread Bet?

Spread Betting Strategies - 8 Simple Steps to Success | 3DMarkets

What is Spread Betting? Going Long, Going Short How it Works History and Risk - Bucket Shops and the City Spread Betting Versus Trading Advantages and Disadvantages Rolling Share Bets - what, how and why Spread Trading Versus dealing with a Forex Broker Vince Stanzione Corner - No fluff and free for a change Interviewing specialist mcx sx forex raider Lucian Miers Daily Market Commentary: Updated Daily at 9am Questioning the issue of Sports Sponsorships in Trading.

Reviews and Features Ayondo: Any good or bad experiences? Looking into Ayondo Social Trading Checking the New LCG. Interviews Checking InterTrader's No Dealing Desk Platform Ayondo Tradehub Platform Review Interview with Spreadex's MD Jonathan Hufford Interview with Sarah, Managing Director at Ayondo.

The spread betting provider will quote a price range or 'spread' and you can forecast whether a stock, index or other financial instrument will rise or fall. Prices quoted can move very rapidly as they reflect actual market conditions.

Winning Spread Betting Strategies - InterTrader

The way it works is that you place a bet on the financial spread trading strategies and which way you think it is going to go - you can profit equally easily from the price going up or down. If you forex jobs no experience a specific stock index like brokerage stock trading india FTSEcurrency pair or commodity will rise or fall, you can bet so much a point and either keep the end date open or set a time limit, which is normally a day or three months forward to close the trade.

For every point the trade moves in your favour, you win multiples of your stake and for every point it moves against you lose multiples of your stake. We will go into this in more detail later. Your profit or loss is the difference between the price at which you enter and the price at which you close the trade.

The more the market moves in your direction you have predicted, the greater your profit. Conversely, when the market moves against you, the more you lose. The danger is that the loss may exceed your deposit margin. The fees are in the spread - so watch the spread. There is no CGT, stamp duty, explicit trading commissions. Trading on margin allows traders and investors to open larger positions, which makes it viable to target relatively small price movements.

But bear in mind you may still need the money to back it up!! And don't forget, importantly it's easy to place down bets which means that you can use spread trading to sell short so as to profit from any correctly predicted price declines. As you do not physically own the product, but trade solely on price movements, you can profit from falling markets as well as rising markets. This is a handy guide to financial spread betting - how it works, have fun and hopefully make a few quid.

Our guide covers an impressive amount of ground, starting out with tutorials and learning about spread betting right down to working out exposure and the psychology of making a trade.

Top Spread-Betting Strategies | Investopedia

Learn the mechanics and advantages of spread betting, including short selling and trading on margin. Plus how to develop a trading plan and the fundamentals of risk management. Continues here - Spread Betting Basics and Summary.