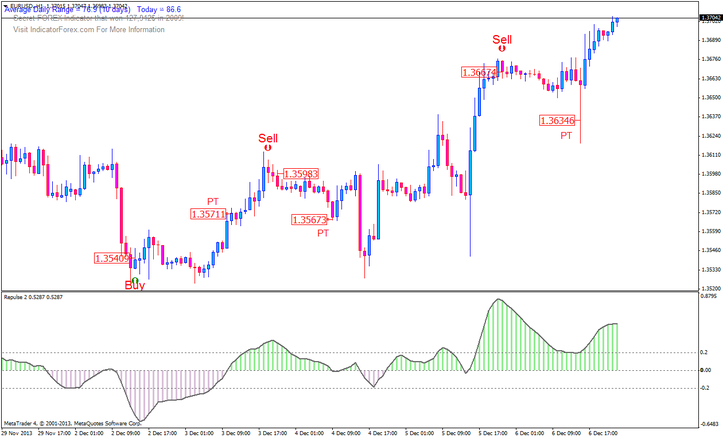

Trading signals rsi

A rising centerline crossover indicates increasing strength in the market trend and is seen as a bullish signal until the RSI approaches the 70 line i. A falling centerline crossover is an indication of weakening strength and so long as the value does not drop below 30 into the oversold region of the scale, is considered a bearish signal. Putting It All Together. This is for general information purposes only - Examples shown are for illustrative purposes and may not reflect current prices from OANDA.

Relative Strength Index - Technical Analysis

It is not investment advice or an inducement to trade. Past history is not an indication of future performance. All other trademarks appearing on this Website are the property of their respective owners.

How to Day Trade with the RSI - Tradingsim

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Refer to our legal section here. Financial spread betting is only available to OANDA Europe Ltd customers who reside in the UK or Republic of Ireland. CFDs, MT4 hedging capabilities and leverage ratios exceeding The information on this site is not directed at residents of countries where its distribution, or use by any person, would be contrary to local law or regulation.

OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association. Please refer to the NFA's FOREX INVESTOR ALERT where appropriate. OANDA Canada Corporation ULC accounts are available to anyone with a Canadian bank account.

Relative Strength Index (RSI) | Forex Indicators Guide

OANDA Canada Corporation ULC is regulated by the Investment Industry Regulatory Organization of Canada IIROC , which includes IIROC's online advisor check database IIROC AdvisorReport , and customer accounts are protected by the Canadian Investor Protection Fund within specified limits.

A brochure describing the nature and limits of coverage is available upon request or at www.

OANDA Europe Limited is a company registered in England number , and has its registered office at Floor 9a, Tower 42, 25 Old Broad St, London EC2N 1HQ. OANDA Asia Pacific Pte Ltd Co.

RSI Indicator - Multiply Your Profits | Sunshine Profits

No K holds a Capital Markets Services Licence issued by the Monetary Authority of Singapore and is also licenced by the International Enterprise Singapore. It's important for you to consider the current Financial Service Guide FSG , Product Disclosure Statement 'PDS' , Account Terms and any other relevant OANDA documents before making any financial investment decisions.

These documents can be found here. First Type I Financial Instruments Business Director of the Kanto Local Financial Bureau Kin-sho No. OANDA uses cookies to make our websites easy to use and customized to our visitors.

Cookies cannot be used to identify you personally.

To block, delete or manage cookies, please visit aboutcookies. Restricting cookies will prevent you benefiting from some of the functionality of our website.

Download our Mobile Apps Currency Converter App Forex Trade App.

Overview The Relative Strength Index is straight-forward to interpret, and produces very clear trade signals. The RSI scale has two defined regions - the first one starts at 0 and goes to 30, while the second region covers the scale from 70 to According to Wilder, an RSI value falling within the 0 to 30 region is considered oversold.

Traders assume that an oversold currency pair is an indication that the falling market trend is likely to reverse i. Centerline Crossovers In addition to the overbought and oversold indicators described above, technical traders using the Relative Strength Index also look for what is known as a centerline crossover. A rising centerline crossover occurs when the RSI value crosses over the 50 line on the scale, moving towards the 70 line. A falling centerline crossover occurs when the RSI value crosses under the 50 line towards the 30 line.

Interpreting RSI Signals 4. Losses can exceed investment.