Can a call option be exercised before expiration

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

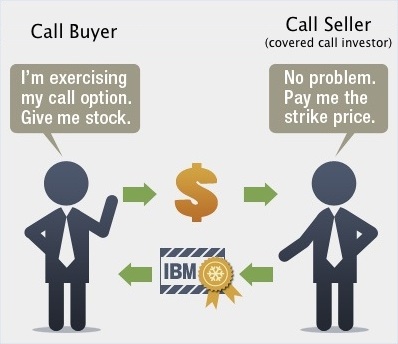

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date.

All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date.

How Often Do Options Get Exercised Early? | OptionsANIMAL

While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:.

Options Strike Price - Avoid the Typical Amateur Mistake of Picking the Wrong OptionAlso assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account. In this scenario, the preferable action would be No Action. Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg.

Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares.

In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

Options Expiration Explained

Given the 3 business day settlement time frame for U. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Can an option be exercised on the expiration date?

Please note that while we read and take into consideration all feedback, we are not able to respond directly to comments or questions submitted through this forum.

Should you have an inquiry or require assistance, please contact Customer Service.

It results in a forfeiture of any remaining option time value; Requires a greater commitment of capital for the payment or financing of the stock delivery; and May expose the option holder to greater risk of loss on the stock relative to the option premium.

The conditions which make this scenario most likely and the early exercise decision favorable are as follows: The option is deep-in-the-money and has a delta of ; 2.

The option has little or no time value; 3. The dividend is relatively high and its Ex-Date precedes the option expiration date. Feedback Please provide feedback on this information Was this information useful?: Was this information sufficient to address your inquiry without further Customer Service assistance?: Tell us what can we do to improve this information: