Call backspread option strategy

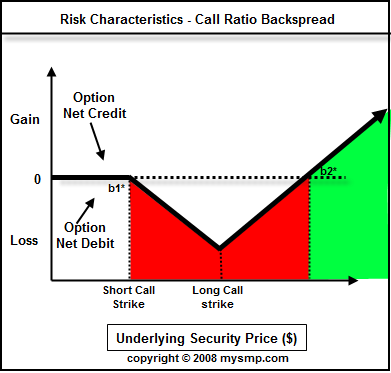

A type of options spread in which a trader holds more long positions than short positions. The premium collected from the sale of the short option is used to help finance the purchase of the long options. This type of spread enables the trader to have significant exposure to expected moves in the underlying asset while limiting the amount of loss in the event prices do not move in the direction the trader had hoped for.

Long Call Spread | Bull Call Spread - The Options Playbook

This spread can be created using either all call options or all put options. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Diagonal Call Spread | Diagonal Spreads - The Options Playbook

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Short Leg Call Ratio Backspread Long Leg Spread Option Bear Call Spread Frontspread Ratio Spread Bull Call Spread Put Ratio Backspread.

Call Options Profit, Loss, Breakeven - Online Trading Concepts

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.