Bull spread call option graph

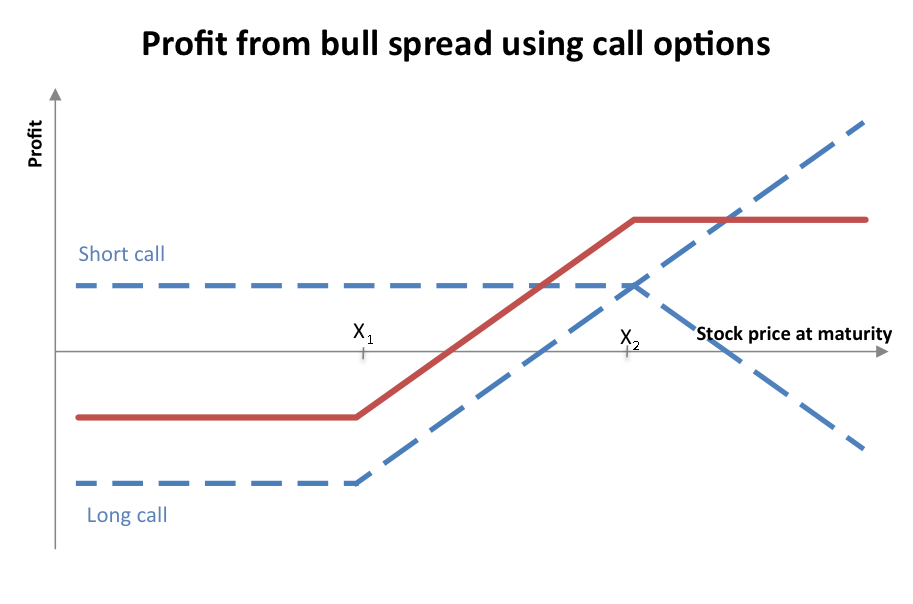

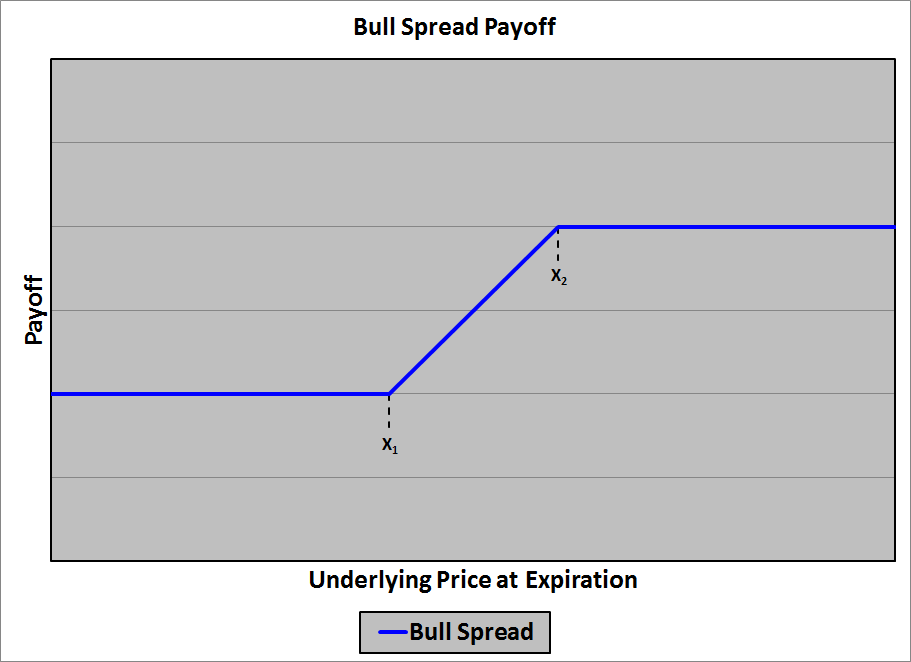

But what if the call premium is too high? A bull call spread is the answer. For other types of vertical spreads , see " What is a Bull Put Spread? A bull call spread is an option strategy that involves the purchase of a call option, and the simultaneous sale of another option with the same expiration date but a higher strike price. In a bull call spread, the premium paid for the call purchased which constitutes the long call leg is always more than the premium received for the call sold the short call leg.

Selling or writing a call at a lower price offsets part of the cost of the purchased call. This lowers the overall cost of the position, but also caps its potential profit, as shown in the example below. Consider a hypothetical stock called BigBucks Inc. Note that while commissions are not included in the calculations below for the sake of simplicity, they should certainly be taken into account in real-life situations. The trader therefore breaks even on the trade but is out of pocket to the extent of the commissions paid.

In this scenario, where the stock trades below the strike price of the long call, the trader loses the entire amount invested in the spread plus commissions.

The maximum loss occurs when the stock trades below the strike price of the long call. Conversely, the maximum gain occurs when the stock trades above the strike price of the short call. The bull call spread is a suitable option strategy for taking a position with limited risk on a stock with moderate upside. Note that in most cases, a trader may prefer to close the options position to take profits or mitigate losses , rather than exercising the option and then closing the position, because of the significantly higher commission that would be incurred with the latter.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Bing-Strategies-bull-call | Learn @ OptionsANIMAL

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is a Bull Call Spread? By Elvis Picardo, CFA Share.

Bull Call Vertical Debit Spread Option Graphs

Example Consider a hypothetical stock called BigBucks Inc. Calculations These are the key calculations associated with a bull call spread: Profiting from a Bull Call Spread A bull call spread should be considered in the following trading situations: A bull call spread makes sense if calls are expensive, as the cash inflow from the short call will defray the price of the long call. Moderate upside is expected: This strategy is ideal when the trader or investor expects moderate upside in a stock, rather than huge gains in it.

If the expectation was for the latter, it would be better to hold long calls only on the stock, in order to derive the maximum profit. With a bull call spread, the short call leg caps gains if the stock appreciates substantially.

Bull Call Calculator

Risk is sought to be limited: Since this is a debit spread , the most the investor can lose with a bull call spread is the net premium paid for the position. The tradeoff for this limited risk profile is that the potential return is capped. Options are suitable when leverage is desired, and the bull call spread is no exception. For a given amount of investment capital, the trader can get more leverage with the bull call spread than by purchasing the stock outright.

Advantages of a bull call spread In a bull call spread, risk is limited to the net premium paid for the position. There is little risk of the position incurring runaway losses, unless for some unfathomable reason the trader closes the long call position - leaving the short call position open - and the stock subsequently surges.

A relatively conservative trader may opt for a narrow spread where the call strike prices are not very far apart, as this will have the effect of minimizing the net premium outlay while also restricting gains on the trade to a small amount. An aggressive trader may prefer a wider spread to maximize gains even if it means spending more on the position.

A bull call spread has a quantifiable, measured risk-reward profile. Risks The trader runs the risk of losing the entire premium paid for the call spread if the stock does not appreciate.

Bull Call Spreads - A Cheaper Way to Be Long OptionsThis risk can be mitigated by closing the spread well before expiration, if the stock is not performing as expected, in order to salvage part of the capital invested in it. There is a possibility of an assignment mismatch if you are assigned well before expiration on the short call leg. Selling a call implies that you have an obligation to deliver the stock if you are assigned, and while you could do so by exercising the long call, there may well be a difference of a day or two in settling these trades.

Profit is limited with a bull call spread, so this is not the optimal strategy if a stock is expected to make big gains. The Bottom Line The bull call spread is a suitable option strategy for taking a position with limited risk on a stock with moderate upside.

A bear call spread is an option strategy that involves the sale of a call option, and the simultaneous purchase of a call option on the same underlying asset with the same expiration date but A bull call spread, also called a vertical spread, involves buying a call option at a specific strike price and simultaneously selling another call option at a higher strike price. A bull put spread is a variation of the popular put writing strategy, in which an options investor writes a put on a stock to collect premium income and perhaps buy the Knowing which option spread strategy to use in different market conditions can significantly improve your odds of success in options trading.

A bear put spread entails the purchase of a put option and the simultaneous sale of another put with the same expiration but a lower strike price. Learn how to take a position in Southwest Airlines' stock using option strategies that have limited or defined risk. Find out more about option spread strategies, and how to set the strike prices for bull call spreads and bull put spreads Learn about option strategies investors can use to take a position in the utility sector, including covered calls and option Learn about debit and credit option spread strategies, how these strategies are used, and the differences between debit spreads Review an example of how a trader might use a debit spread to limit the maximum loss on an options transaction, limiting Learn how a short call is used in a bear call spread option strategy, and see how a bear call spread benefits from the time Learn a couple of popular options trading strategies that can be used by investors seeking to enhance their profits from An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.